Used business jets may get tougher to sell

ADS-B mandate among the factors

Three factors, including the fast-approaching Automatic Dependent Surveillance-Broadcast (ADS-B) Out mandate, are expected to drive up the number of used business jets for sale.

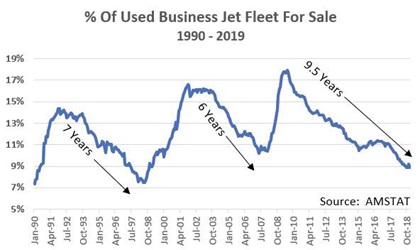

Aviation analyst Brian Foley said the number of used business jets for sale has been on a declining trend for nearly a decade, and was less than 9 percent of the total for-sale fleet in January, a level not seen in 20 years. That’s about half of the percentage of used jets on the market at the height of the financial crisis in 2009, when almost one in five business jets in the operating fleet was posted for sale amid cratering consumer confidence. Foley said he expects the number of used business jets on the market to increase, and probably soon.

GAMA President and CEO Pete Bunce delivered some insight during the organization’s State of the Industry address on Feb. 20, noting that avionics shops are busy installing updated equipment at a rate of about 1,000 piston aircraft per month, and about 500 jets per month are getting the same upgrade.

“We think on the piston side, we’re doing well,” Bunce said, though he added that many aircraft are likely to equip after Jan. 1, 2020, when all aircraft flying in airspace where a transponder is currently required will be required to broadcast their position via ADS-B Out.

Bunce said the turbine fleet is in much the same shape, with roughly 63 percent of business jets ready for the coming mandate. Helicopter installations are lagging, however, with installations in that segment proceeding at a rate of about 100 aircraft per month. “We, as a community, still have a concern about rotorcraft aircraft,” Bunce said.

AEA’s annual market data report released Feb. 19 logged $2.7 billion in annual sales, 57 percent of which was retrofits. Not all of that is ADS-B equipment, but the scramble to meet the deadline appears to be showing up in the top-line numbers.

Foley expects some business jet owners will put their aircraft up for sale rather than pay for the retrofit, and “this will contribute to steadily rising inventory levels throughout the year consisting of undesirable aircraft that won’t sell anytime soon.”

Foley cited two other factors as the basis for his prediction of rising used business jet inventory: a softening U.S. economy, which he said is likely to undermine confidence and reduce discretionary spending on airplanes, and basic analytics. Prior periods of shrinking used inventory lasted for six or seven years, and the current trend is now a decade old.

“As for the effects of an increasing used jet inventory, a significant impact on new aircraft sales isn't expected since an increase in older aircraft is not of interest to typical new aircraft buyers,” Foley wrote. “For used aircraft brokers, somewhat fewer pre-owned sales activity can be expected since rising inventory is indicative of more people wanting to get out of ownership than get in. Finally, don’t expect pricing of used aircraft, which have also been in a tailspin for a decade, to recover much. Whereas supply and demand dynamics once kept used prices propped up, basic capital good economics have caught up to business jets and softer residual values are now the norm. A new business jet now depreciates no differently than a Buick automobile.”