Aircraft shipments up, sustained recovery elusive

Industry leaders cautiously optimistic

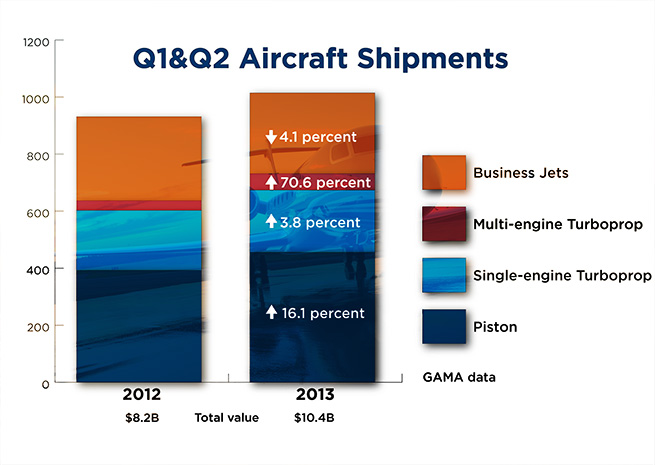

Despite a 26-percent jump in aircraft factory billing reported by the General Aviation Manufacturers Association, based on a comparison of estimates for the first half of 2012 and 2013, signs of real recovery remain elusive.

Airplane billings, data drawn from a variety of sources including company reports (not all manufacturers supply their sensitive sales numbers), rose from $8.2 billion in the first half of 2012 to $10.4 billion in the first six months of 2013.

This rising tide did not lift all bottom lines: A closer look at first-half data for 2013 reveals a mix of growth and decline, including a 4.1-percent overall decline in business jet deliveries. Cessna Aircraft Co. saw bizjet airframe deliveries drop 40 percent in the first half of 2013 compared to the same period in 2012. Cessna’s overall revenue was down 20 percent, based on GAMA estimates derived from third-party sources.

Gulfstream Aerospace Corp., meanwhile, shot past Bombardier Aerospace as the top revenue producer in the market. Industry analyst Richard Aboulafia of the Fairfax, Va.-based Teal Group, attributes that to Gulfstream’s new model, the ultra-long-range, $64.5 million G650, which the company began to deliver to customers at the end of 2012.

“The 650’s going to do that for you,” Aboulafia said of Gulfstream’s newfound supremacy. “Even a couple of 650s.”

Bombardier is hard at work on the Global 7000 and Global 8000, and Aboulafia expects those new models will swing the tide back in the Canadian airframe maker’s favor.

“In five years, or four years … we’ll be having the same conversation about Bombardier,” Aboulafia said.

While new models give manufacturers temporary lift, the real question, Aboulafia said, is what will repair the massive rift torn in the industry by the economic collapse. Prior to 2008, aircraft priced below $25 million generated similar overall revenue to aircraft priced above that benchmark. With the recession, Aboulafia said, “the bottom half was destroyed,” and this tier of the aircraft market is “still looking for signs of recovery, sustainable recovery.”

Aboulafia said a single good quarter—for either a manufacturer or the industry as a whole—does little to convince him times have really changed.

‘Starting to feel closer to pre-recession levels’

GAMA officials released the data with tempered enthusiasm.

“We are encouraged to see a strong increase in billings this quarter, but the mixed results in shipments—and the differences in performance among sectors—demonstrate that GA airplane manufacturers still face some strong headwinds as the global economy recovers,” GAMA President and CEO Pete Bunce said in a news release. “That's why we continue to engage lawmakers and regulators across the globe to improve certification processes and to facilitate the introduction of new, safety-enhancing products to market at a reasonable cost.”

GAMA (and AOPA, along with other industry groups) have supported recent legislative efforts along those lines, notably the Small Airplane Revitalization Act passed by the House of Representatives and approved by a Senate committee in July. The legislation requires the FAA to revamp small aircraft certification rules by the end of 2015.

While the industry presses lawmakers for relief, some airplane makers celebrated progress. Cirrus Aircraft lauded its best first-half delivery tally since 2008 (130 aircraft), driven, like Gulfstream, by new models.

“Momentum at Cirrus, specifically around the Generation 5 SR22 and SR22T, is driving demand for new piston aircraft that is starting to feel closer to pre-recession levels,” said Cirrus Executive Vice President of Sales, Marketing, and Customer Support Todd Simmons in a company news release.

According to GAMA data, Cirrus saw revenue increase 45 percent for the first half of 2013 compared to the same period in 2012, leading the piston GA field, which posted a 16-percent overall increase in airframes delivered.

Beechcraft Corp., which ceased production of its former business jet lines as it emerged from Chapter 11 bankruptcy (and is courting buyers for that part of the former Hawker Beechcraft business) posted an 11-percent increase in total revenue (estimated by GAMA), and a 65-percent increase in airframe deliveries while the average unit cost (GAMA-estimated revenue divided by deliveries) declined by a third, reflecting the company’s transition to piston and turboprop lines. The recently announced deal with private aviation start-up Wheels Up, which is purchasing up to 105 King Air 305i turboprops and comprehensive maintenance support with a total value of up to $1.4 billion, promises to boost Beechcraft’s bottom line starting in the second half of 2013.

Piper Aircraft logged an 11-percent increase in revenue and 13-percent increase in airframes delivered (from 76 to 86) comparing the first-half totals from 2012 to 2013. Diamond Aircraft saw a slight decline in aircraft deliveries (67 to 64 for the first-half deliveries between 2012 and 2013), while GAMA estimates Diamond’s revenue increased 12 percent.

Cessna, meanwhile, also struggled with its piston lines, posting an 18-percent drop in piston airframe deliveries, according to GAMA data. The troubled C162 Skycatcher has disappeared from the 2013 GAMA reports, and FAA registration data shows no new registrations of Cessna’s lightest aircraft since AOPA Online reported in March on the apparent cessation of Skycatcher shipments. Cessna still owns more than 80 of the 276 Skycatchers in the U.S. registry.

At the turbine end of Cessna’s business, competition from Brazil’s Embraer (which logged a 55-percent increase in GAMA-estimated revenue for the first half of 2013 compared to the first half of 2012), along with the overall market decline, are causing the company problems, Aboulafia said.

“Part of it is Embraer. Most of it is the market,” Aboulafia said of Cessna's woes, adding that premature price hikes probably made matters worse by depressing demand.

Cessna plans to begin delivering the Citation M2 by year’s end, and also recently announced the first production flight of the Citation X, with which Cessna will reclaim the production aircraft speed record from Gulfstream’s G650—Mach 0.935 for the Citation X.

Aboulafia said Cessna’s recent job cuts may also affect the company’s long-term future. He said Cessna has trimmed engineers, management, sales, and product development staff. Bizjet makers must constantly update and upgrade to keep up with the competition.

“The drastic cuts that they suffered,” Aboulafia said, “that’s going to have a bearing on the company’s (ability to compete).”